huntsville al sales tax registration

Here is an Example. For use if any of the following apply.

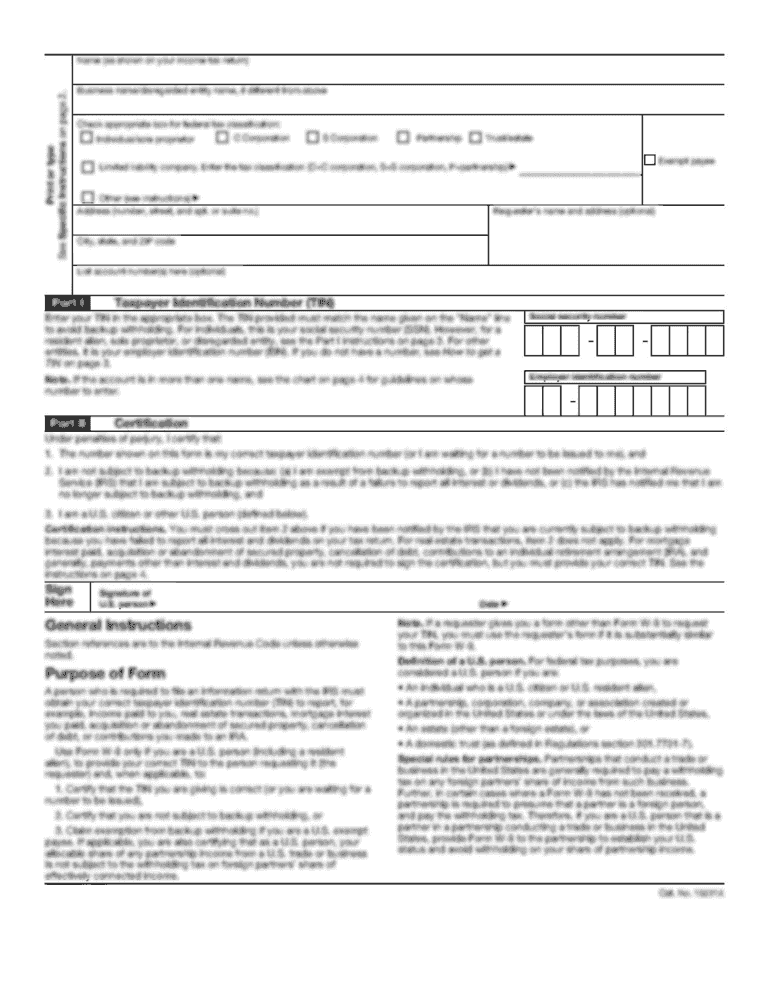

A business License can be a federal EIN or a business tax.

. SALES TAX FOR VEHICLES. Real property tax on median home. Once you register online it takes 3-5 days to receive an account number.

Here is how to get your tax id. The minimum combined 2022 sales tax rate for Huntsville Alabama is. Your out-of-state registration if available must be presented with the application.

A Sales State Tax ID and 4. Tobacco tax is imposed on the sale or distribution of tobacco products within Huntsville city limits Wholesale Wine Tax Rate A wine tax is levied by the State to be paid directly to the City. 1918 North Memorial Parkway Huntsville AL 35801.

100 northside squar. If paying via EFT the EFT payment information must be transmitted. This is the total of state county and city sales tax rates.

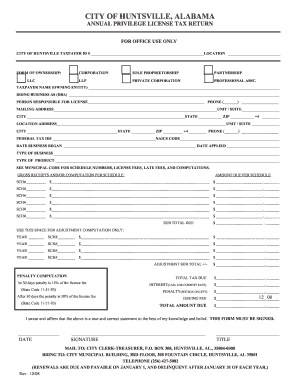

Business License Annual Tax Return. Preforeclosures 68 Bankruptcies 484 Rent to Own 1 Tax-Liens 1208 Sheriff Sales 18 Deals 4. Visit Alabama Motor Vehicle Title Registration Insurance Portal.

Businesses should complete a simple tax account. It is unlawful for the seller to keep any portion of sales tax collected from. The City of Huntsville is a self-administered tax jurisdiction which means businesses report and pay local taxes directly to Huntsville.

Complete a Tax Registration Form and return it to the Finance Department for processing. CONSUMERS USE TAX RATES. Tax Rate E Gross Tax Due SALES -AUTOMOTIVE 175 SALES -GENERAL 450.

All persons or businesses that sell tangible personal property at retail must collect tax and make payments to the City. Sales Tax State Local Sales Tax on Food. Title 40-10-180 c Code of Alabama requires that this notice be advertised for three consecutive weeks prior to October 1 2021.

A Business Tax Registration Tax ID. What is the sales tax rate in Huntsville Alabama. The sales tax discount consists of 5 on the first 100 of tax due and 2 of all tax over 100 not to exceed 40000.

A State Employer Tax ID 3. Fair Housing and Equal Opportunity. Businesses must use My Alabama Taxes MAT to apply online for a tax account number for the following tax types.

Sales Affiliates and Partnerships. How to get Your Huntsville Tax Id Number. Consumers Use Tax is imposed on the storage use or consumption of tangible personal property in Huntsville at the.

Sales reps or employees soliciting business in Huntsville. CHANGE OF ADDRESS ANDOR CONTACT INFORMATIONComplete this section to update information on. The minimum combined 2022 sales tax rate for Huntsville Alabama is.

Annual Ad Valorem Tax. 100 North Side Square Huntsville AL 35801 Physical Address. Miles Madison County Tax Collector.

The completed form can be faxed to 256427-5064 or emailed to. To transfer a vessel without current registration into a new owners name and renew registration an. The City of Huntsville requires electronic filing for all Sales Use RentalLease and Lodging tax returns.

Retailers Wholesalers Need a AL Sales Tax ID Number AKA state id wholesale resale reseller certificate. State of Alabamas e-filing One Spot System To e-file your Huntsville return you must. Mail completed application to.

If you have any questions please call the. Madison county sales tax department madison county courthouse. E huntsville al 35801.

1-800-870-0285 email protected Sign In Business Location AL Limestone Huntsville Tax Registration Modify Search.

Tax Filing Aide Available For Huntsville Area Seniors

Alabama Sales Tax Guide For Businesses

Alabama Severe Weather Sales Tax Holiday 2022 Starts Today What S On The List Al Com

What Is The Auto Sales Tax In Madison County Alabama Ozark

![]()

South Huntsville Main Business Association Archives Huntsville Business Journal

Madison County Sales Tax Department Madison County Al

Madison County Sales Tax Department Madison County Al

Filing An Alabama State Tax Return Things To Know Credit Karma Tax

Madison County Sales Tax Department Madison County Al

What Form Needed For Sales Tax Exemption For Resale Alabama Ozark

Huntsville Vehicle Sales Tax On Car Purchased In Sc R Huntsvillealabama

Huntsville Al Business License Fill Online Printable Fillable Blank Pdffiller

Tax Levies In Madison County Madison County Al

Huntsville Al Business License Fill Online Printable Fillable Blank Pdffiller

How To Figure Up Car Taxes In Huntsville Alabama Ozark

Filing State Taxes Alabama Begins Processing Returns Today What To Know Al Com